Smarter Way To Secure

Your Mortgage

Burrow Mortgages

Originally started as Dwell Mortgages but later changed to Burrow – A smarter way to secure your mortgage. A Simple free mortgage broker. Using machine learning and product matching algorithm to smart search 11,272 mortgage products from 106 trusted UK lenders and help secure the most suitable mortgage deal for customers.

Become a Mortgage Guru

Illustrations by Martina Paukova

Rebuilding how you get mortgages

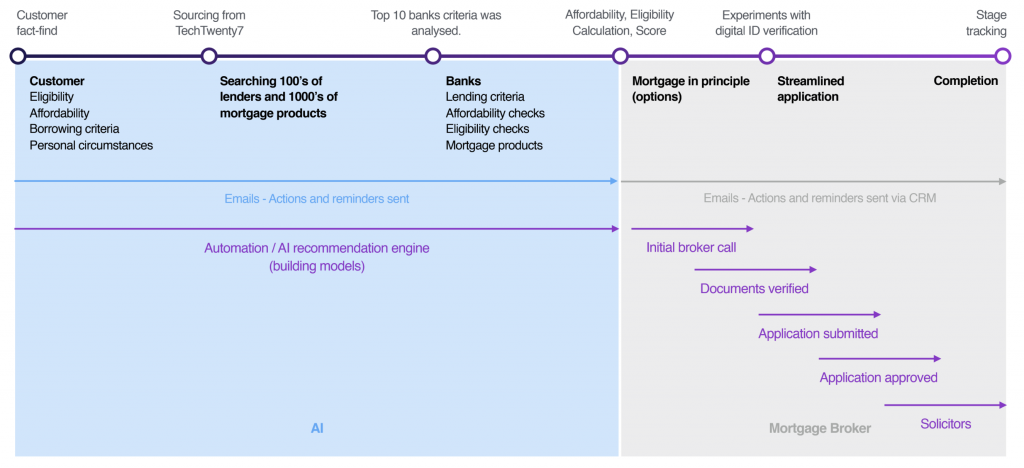

The initial approach we took, was to map out the full end to end customer journey, discovering the needs of our customer segments and uncover how they felt at that particular moment of their life cycle, whilst also mapping out the business challenges brokers faced at those points. After understand the problems across the customer journey, it exposed opportunities we could capitalised on and find solutions to customer problems.

Customer problems

- I want to see how much I can afford to borrow

- Fact find feels invasive, impersonal and long

- Overwhelmed with comparison site results

- Don’t trust brokers – they recommend only one option

Business problems

- Industry is paper based, slow and causes delays

- Finding the right mortgage takes time to source

- Prioritising cases for maximum return

- Managing customers at different stages in their search

High level process

Customer research and interviews

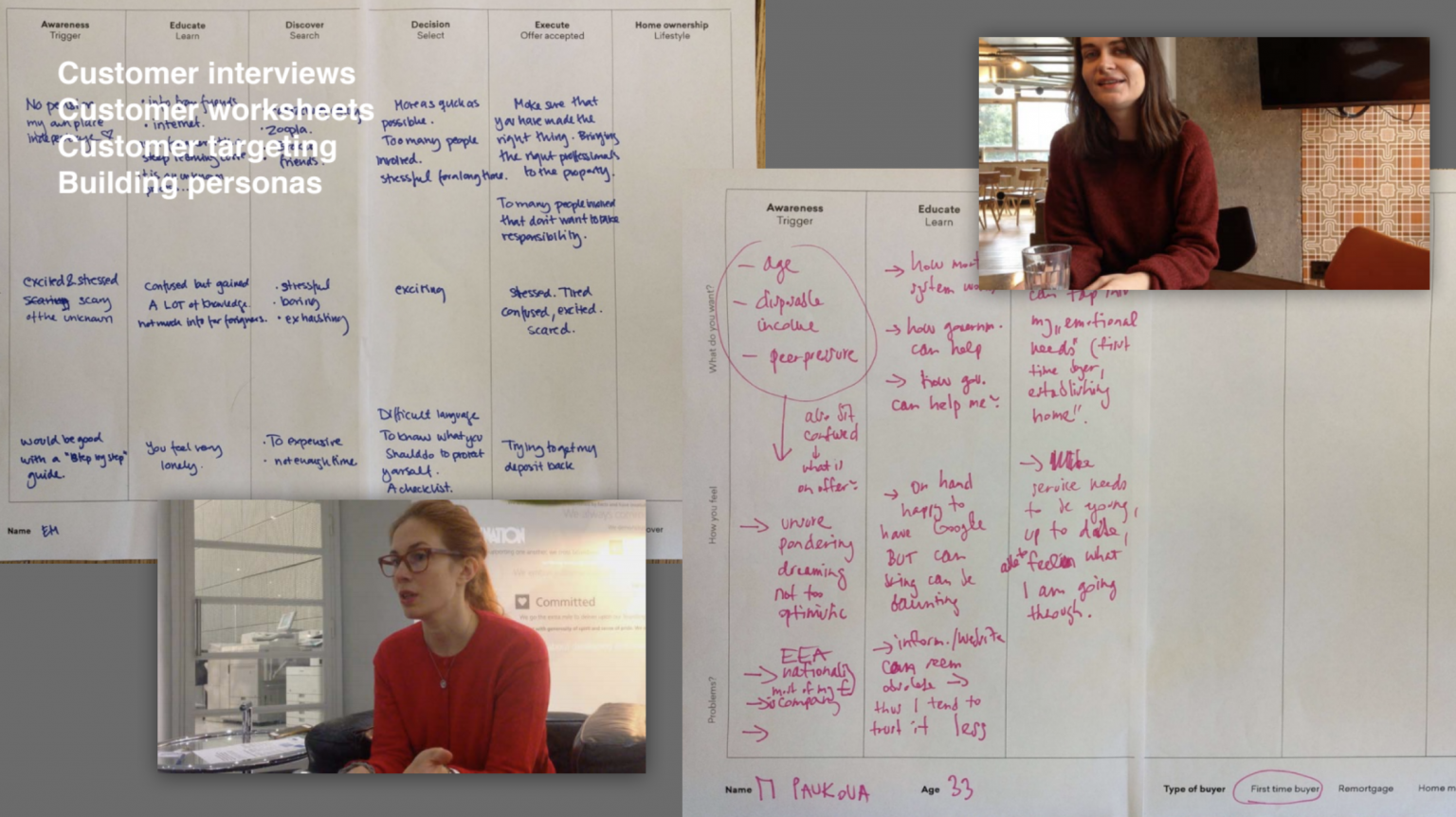

I conducted over 20 customer interviews with different customer segments from ‘First-time buyers’, ‘People looking to remortgage’ all the way to ‘Buy-to-let landlords’, to help find which market segment would be an open opportunity to focus on.

I created a worksheets to help the customer explain the process and recorded each interview for reference and highlight key moments. Key findings were presented back to the team and help us to define our future products and experiments.

Product strategy and workshops

I conducted and facilitated a large number of workshops to understand the full customer journey and the customer life cycles to help identify opportunities in the journey. After identifying some key opportunities we ran several ideation workshops to create concepts that can be developed into actual product experiments.

Designing new products to find product market fit

I launched a number of different experiments to measure success but also to test our assumptions based on what was uncovered as key customer needs. The experiments covered affordability across the top 10 lenders, eligibility across the top 10 lenders, providing customers with mortgage options across all available lenders, mortgage in principle and mortgage complexity scoring to help customers see how much ‘borrowing power’ they have.

Experiment 1

Mortgage options (Dwell Mortgages)

Helping people choose the right options

Experiment 2

Universal Mortgage Calculator

Affordability – See how much different banks lend.

Experiment 3

Mortgage checks

Check if you are eligible for a mortgage.

Dwell mortgages - 3 options (conversional UI)

We focused our efforts on creating a digital experience that captures customer details in a simple and effortless way. I found inspiration from Typeform – a single question and answers interface and conversational UI, perfect for a mobile touch experience and proven to increase conversion in long forms by up to 70%. We also took steps to simplify industry jargon, translating messaging into easy to understand questions that made the form feel more dynamic and easier to complete.

From earlier customer interviews we found customers were overwhelmed by results found on comparison sites during their research stage. A matchmaking algorithm was developed to match a customer’s borrowing criteria with a bank’s lending criteria and automated the mortgage product selection process (sourced from Twenty7tech). We wanted our experience to be simple and transparent, by sending the 3 most suitable options via email to simplify the customers decision process and assigned a personal mortgage broker to support them through the process.

After launching our initial MVP we identified new needs to add future iterations and new features like ‘save for later’ so customers can fill in their details for later.

User acquisition and digital marketing

We launched specific campaigns to drive traffic to our remortgage campaign landing pages todrive acquisition, starting with Facebook as our initial acquisition experiment.

Lower payments

Borrow more

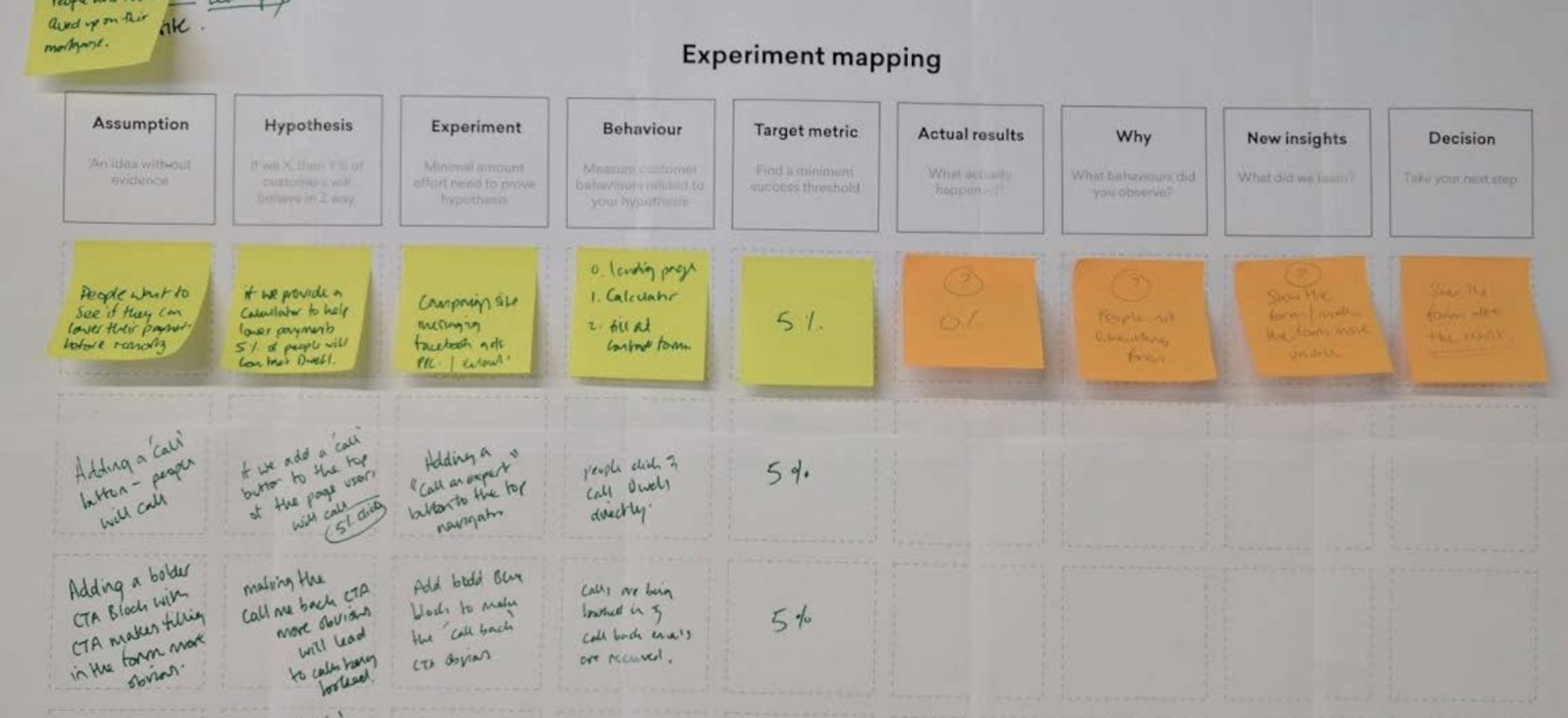

Experimentation map - measuring success

I used a very good experiment framework which I continue to use, called lean experiment mapping. The benefits of using this framework is that it forces you to use a hypothesis driven approach, helps you measure the impact of your work, helps to tell a story of success, continuously make improvements and identify traction.

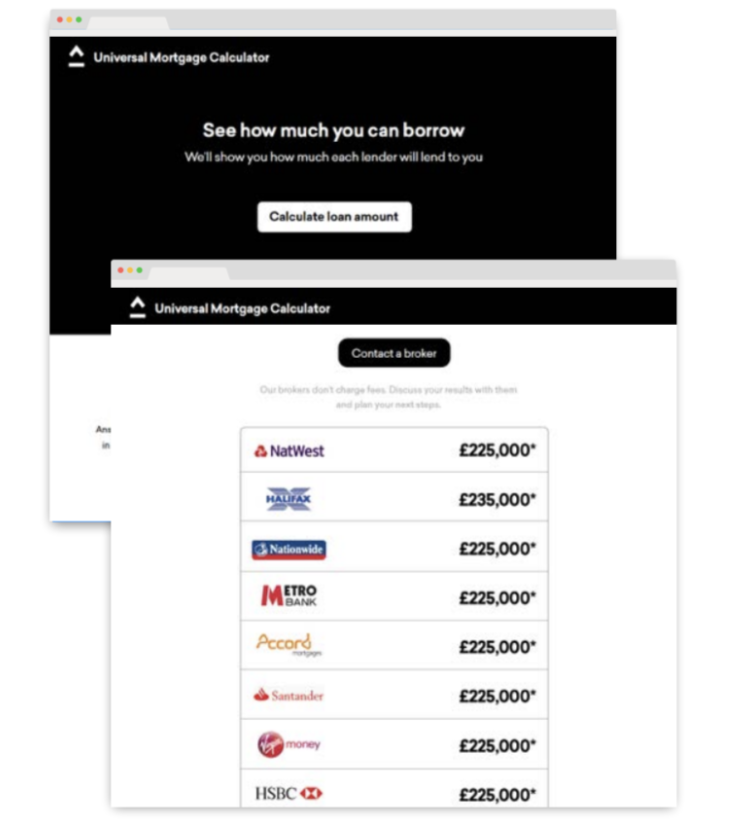

Universal mortgage calculator

Earlier insights and learnings from inbound calls indicated that customers in the research phase also wanted a quick way to find out their affordability. A customer’s first stop was a comparison site which returned results available but only based on a 4.5 x multiple, unfortunately not an accurate affordability calculation.

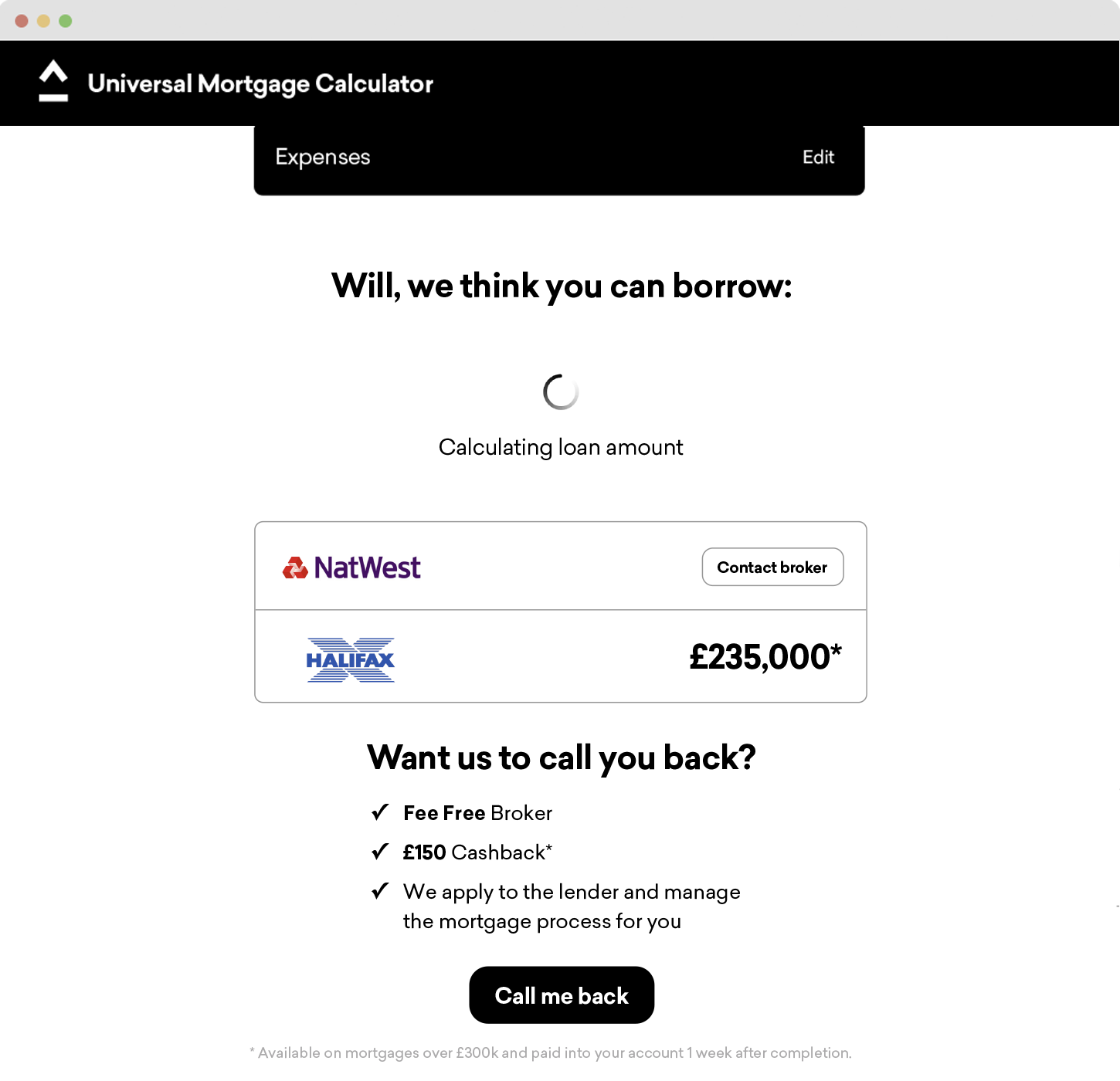

Because of the lack of transparency we built the ultimate mortgage calculator. We used intermediary calculators to give us accurate results as part of our criteria collection and searched across the top 10 lenders on the market. What we were able to demonstrate was that each bank lends different amounts because each bank’s lending criteria differs. The difference between lenders could be as large as £150,000. We launched this as a separate experiment to provide our customers with the tools they need and measure its use. The tool was used over 19,000 times in the first month! We switched the tool to be a lead generation tool where we could capture customer data and support them in finding the right mortgage.

Affordability calculator

Results loading inline

Results screen

Call back

Share with friends

Quick Eligibility check

To help people find out if they could even get a mortgage, for example self employed individuals can find it hard to borrow. We created a tool to help customers understand how easy or complex a mortgage would be to get – we called this a borrowing score from 0 (complex case) to 1000 (easy case). This solution did reduce call volume but its usage wasn’t as much as the calculator, however our learnings showed that this was a way to prioritise deals. We later a traffic light system / back office solution to help the mortgage team prioritise deals – focusing on cases that were of higher value and faster to transact.

A change in direction

Hyper-personalisation

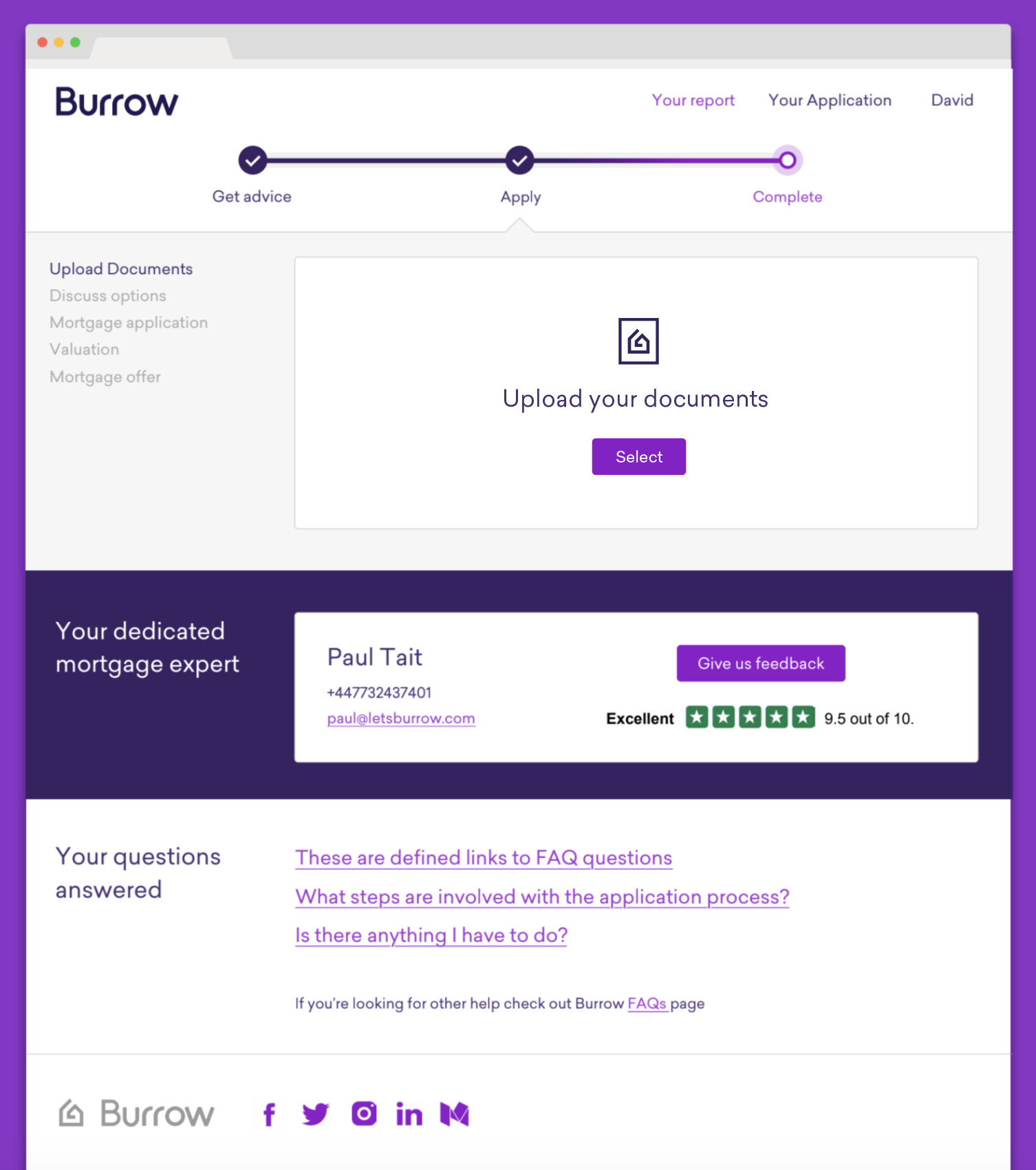

New name, new logo and new approach. We decided to rename and reposition as Burrow Mortgages – Your home for mortgages. Providing customers with a hyper-personalised view of their mortgage options.

We combined all of the learnings from previous experiments, simplifying the form filling experience and streamlining the process to a matter of minutes. We created a mortgage report, a summary of your mortgage health that included instant mortgage in principle, your mortgage score and your mortgage options that can be updated inline.

A simple mobile experience

Users can continue their application on desktop after completing their report on mobile.

Automating the experience

Using matching algorithms and personalise mortgage recommendations to automate the mortgage selection process for the broker. Our automation technology created a number of opportunities to explore partnerships and use our white label platform with Totally Money and explore B2B opportunities directly with mortgage lenders.

Mortgage report

Combining all of the elements from our affordability calculator Universal Mortgage Calculator, eligibility Mortgage Checker and Dwell Mortgage Options to give you a “hyper-personalised” view of your mortgage options.

Mortgage Score

The score indicates the confidence level in getting a mortgage. We shared more details on how much each lender would be willing to lend and mortgage type (e.g. fixed, variable, repayment, interest only).

Case prioritisation scoring

Back-office we designed a case prioritisation scoring system enables brokers to prioritise cases based on speed to transaction vs. deal size to give better ROI (current 6 months to convert). Other factors included affordability and eligibility.

Mortgage report

Mortgage score / purchase price / loan amount / deposit required /

mortgage in principle

Your application

Simplifiaed document verification / review mortgage option /

personal mortgage handler

Managing multiple streams, delivery and execution

Design and sprint planning

Design was planned 2-3 weeks ahead of development sprints to better define user stories and a pre sprint planning meeting was scheduled the week before a development sprint starts.

Evolving innovation within the business

An ideas gathering system was created and hooked into a Trello board to manage ideas outside of product development and bi-weekly meetings were held with the founding team to review ideas before taking anything forward for consideration by the business.

Backlog prioritisation and user story definition

Regular planning meetings to decide which user stories should be prioritised and put into design and development. Backlog items using an effort vs impact matrix and scoring system and were either qualified or removed to reduce any confusion and new ideas added as the vision evolved.

Development sprint planning

All development work was estimated in terms of effort and managed using Jira and a kanban view to track sprint progress and a planned build was released every 2 weeks.

User testing, QA and resolving issues

Regular testing sessions across the team was a shared responsibility between the product team and development teams, any issues found would be reported and added to the backlog and prioritised as fixes.

DPR, a provider of mortgage technology, has acquired online mortgage broker Burrow, a group that promises to make mortgages “delightfully digital”.

Recognised as a top 3 disruptive digital mortgage brokers in the UK and received substantial press coverage.

Processed over 200 mortgages since launch.

Universal Mortgage Calculator was used over 19,000 times in the 1st month of launch.

Relaunched as Burrow a hyper-personalised product and later pivoted to provide B2B technology and lender partnerships.

Launched partnership Totally Money ‘White-labeled’ product to drive acquisition and reliable mortgage advice. Previously in discussions with Money Super Market and Compare The Market for future partnerships.

“David is brilliant beyond design – he’s a rare blend of business, strategy, product design, brand with commitment, vision and passion that helped us launch Dwell mortgages and later rebrand as Burrow mortgages.

He has an amazing ability of getting the best from people and it’s David’s versatility and personality that makes him such a pleasure to work with.”

Pradeep Ramen